Nvidia Breaks Global Record, Surpassing $5 Trillion Market Capitalization

American leading semiconductor manufacturer Nvidia has achieved a historic milestone in the global technology industry by surpassing a market capitalization of $5 trillion.

This unprecedented achievement positions Nvidia as the first company worldwide to reach such a valuation, according to industry analysts and financial experts.

The company’s stock rose nearly 3%, reaching $207.16 per share, which pushed its overall value to new record heights.Nvidia’s dramatic rise began late last year when its market cap first crossed $2 trillion.

Within just a few months—66 trading sessions—it surpassed $3 trillion, and by July 2025, it became the world’s first company to hit a $4 trillion valuation, outpacing giants like Elon Musk’s corporations, Apple, and Microsoft.

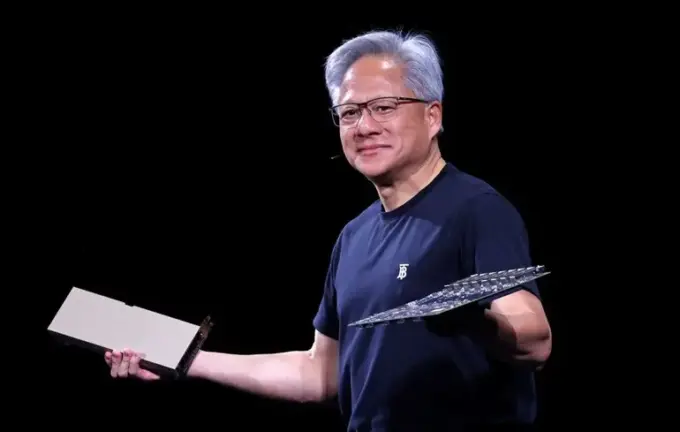

This rapid growth attracted the attention of investors and analysts, who now see Nvidia as a pivotal player in the ongoing technological revolution.CEO Jensen Huang emphasized during a speech in Washington that Nvidia is at the forefront of artificial intelligence advancements.

The company primarily develops graphics processing units (GPUs), which are essential components in modern AI and machine learning systems.

Reports indicate that Nvidia has already shipped over 6 million Blackwell chips, launched last year, with an additional 14 million units on order.According to Dow Jones Market Data, Nvidia’s current market value exceeds the combined capitalization of giants such as AMD, Arm Holdings, ASML, Broadcom, Intel, Lam Research, Micron Technology, Qualcomm, and TSMC.

Its market volume surpasses entire sectors of the S&P 500 index—including industrials, utilities, and consumer goods.Over the past two years, Nvidia’s growth has been unprecedented: in March 2024, it first exceeded $2 trillion; shortly after, it topped $3 trillion, and by July 2025, its valuation reached $4 trillion, making it the global leader in AI chip technology.

Industry experts believe Nvidia’s stock remains a strong indicator of high demand for cutting-edge tech.Despite spectacular growth, analysts warn of the potential formation of a market ‘bubble’ similar to the dot-com collapse.

The company actively invests in data centers and AI development but is yet to turn a profit commensurate with its expenditures.

Nvidia has announced plans to invest up to $100 billion in collaboration with OpenAI to build AI systems powered by its chips, along with funding several startups in the AI field.One of the key risks is geopolitical: restrictions on chip exports to China could impact Nvidia’s revenues.

Trade negotiations between the US and China could influence this aspect of the business significantly.Overall, Nvidia maintains its position as the leader in AI chip manufacturing.

Its future strategies and investments will significantly influence the trajectory of the global high-tech industry in the coming years.