Global Central Banks Shift Away from US Securities Towards Gold: A New Phase in the International Financial System

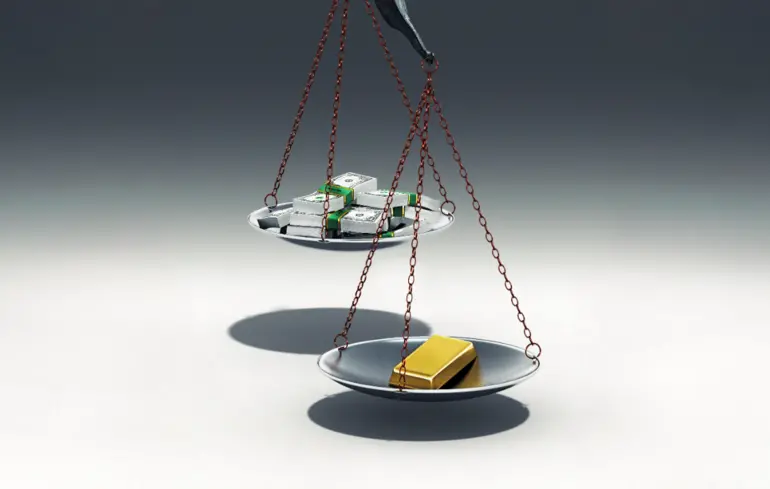

World central banks are actively reevaluating their investment portfolios, increasingly abandoning traditional US securities such as Treasury bonds and shifting focus towards purchasing and holding gold.

This trend reflects not just strategic changes in finance but signifies deeper transformations within the global economy and the international monetary system.

Gold, which remains unaffected by political or economic crises in individual countries, is currently hitting record high prices — over $3,600 per ounce, with analysts forecasting it could soon climb to around $3,700.Significant shifts are taking place in reserve currency structures.

For example, the US, long the dominant player in holding government debt, is now facing competition.

Data shows that China, once the largest holder of US Treasuries, reduced its holdings from $1.2 trillion to $750 billion, dropping from the first to the third position among foreign investors in US debt.According to IMF data, total global foreign exchange reserves amount to about $11.6 trillion, with 58% denominated in dollar assets.

Interestingly, the breakdown of financial instruments reveals that nearly 34% of reserves — approximately $3.9 trillion — are in the form of Treasuries, while gold investments amount to $3.86 trillion.

This indicates an increasing role for gold and long-term US government debt in the global economy, raising questions about shifting power balances.

Experts warn against reckless risks, emphasizing that more countries are seeking to diversify their reserves into gold as a hedge against potential currency crises and geopolitical uncertainties.