China’s Economy: Potential, Challenges, and Future Horizons — An In-Depth Analysis of the Current Situation

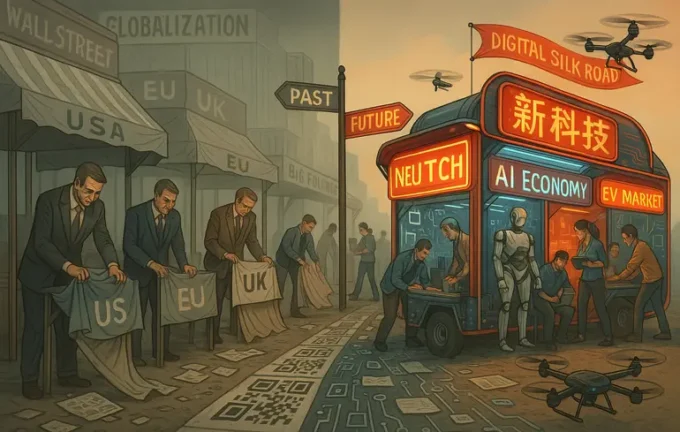

The global stage is undergoing significant transformations, with traditional hegemonies gradually ceding their dominance and new centers of influence emerging in a rapidly changing geopolitical and economic landscape. Among the most prominent of these is China, often described as a “colossus on clay feet” or as a potential new world leader. Analyzing China's current economic state reveals that the country is in a period of unstable stability — a condition that can quickly shift depending on numerous internal and external factors. As of 2024, China's Gross Domestic Product (GDP) stands at approximately 18.4 trillion USD, which is about 63% of the U.S. economy, valued at over 29 trillion USD. However, these numbers only tell part of the story, as China's internal economy remains significantly undervalued due to pricing manipulations and currency maneuvers—actively concealing the true scale of its GDP by undervaluing it by 20-30% through low inflation and exchange rate policies. Consequently, based on Purchasing Power Parity (PPP), China now surpasses the United States to become the world's largest economy. The turning point in the China-U.S. economic relationship occurred prior to the 2007 global financial crisis when China's GDP was around $3.55 trillion — just 24% of the U.S. figure. Within two years, this ratio improved to 40%, and by 2019, it reached 66%. After the pandemic's end in 2021, this indicator grew to about 75%, creating the perception that China is poised to catch up with the U.S. in economic potential. Nevertheless, various factors such as the yuan's devaluation, global crises, and the pandemic have shown that this transition is still ongoing and fraught with obstacles. Historical retrospectives, from the Cold War era to recent decades, illustrate how China’s economic relations with the U.S. fluctuated depending on external shocks and internal developments. A crucial takeaway is that China tends to strengthen its position during large-scale crises, including wars and financial downturns involving the U.S., whereas periods of stability or political uncertainty often slow down its momentum. In 2024, China’s economy is growing at about 5%, but this rate is influenced by numerous headwinds: demographic decline, sluggish domestic consumer demand, and reduced foreign investment flows. Despite this, China actively develops high-tech industries—electric vehicles, semiconductors, robotics—maintaining a competitive edge in global value chains. Investment in manufacturing and infrastructure is increasing, while foreign direct investments are contracting in some sectors, prompting China to seek alternative funding sources via government-guaranteed bonds and global financial instruments. Demographic challenges — particularly aging and declining population growth — represent a critical issue, as an aging workforce impacts internal consumption and the overall economy. Currently, 61% of the Chinese population is economically active, while 16% are over 65 years old. The country lacks a comprehensive pension system, which intensifies fiscal pressures on young families supporting elderly relatives. To address this, China may need to reform its social policies, including introducing universal pension schemes and boosting domestic purchasing power. The recent population census indicates a significant rise in private enterprises and employment in the secondary and tertiary sectors — with over 33 million legal entities and nearly 429 million employed, figures higher than the total populations of the EU and the USA combined, debunking claims of demographic overestimation. Overall, China does not yet claim global hegemony but has clearly targeted Eurasian dominance, with a strategic focus on innovative technologies and internal markets, especially within Asia. Its trajectory is reminiscent of Western countries fifty years ago, as they transitioned from manufacturing-based economies to consumption-driven models, a process that China is now undertaking. This transition is occurring against the backdrop of a broader decline in Western social welfare models, which are struggling to adapt to new economic realities. While China is “heading to the fair,” Western economies seem to be retreating from their previous dominance, marking a shift in the global economic balance.